Simple Ways to Order Cryptocurrencies: Beginner-Friendly Platforms Explained

Wiki Article

Exploring the Advantages and Dangers of Spending in Cryptocurrencies

The landscape of copyright investment is identified by an intricate interaction of compelling advantages and significant risks. As we even more analyze the nuances of copyright financial investment, it ends up being apparent that informed decision-making is extremely important; nonetheless, the concern remains: How can capitalists effectively stabilize these benefits and risks to safeguard their monetary futures?

Comprehending copyright Fundamentals

As the digital landscape advances, comprehending the basics of copyright becomes crucial for prospective financiers. copyright is a type of digital or digital currency that uses cryptography for protection, making it tough to copyright or double-spend. The decentralized nature of cryptocurrencies, typically improved blockchain innovation, enhances their safety and transparency, as purchases are tape-recorded throughout a distributed journal.Bitcoin, produced in 2009, is the initial and most widely known copyright, but hundreds of alternatives, called altcoins, have arised because after that, each with unique functions and functions. Capitalists must acquaint themselves with essential principles, including budgets, which store personal and public tricks required for purchases, and exchanges, where cryptocurrencies can be bought, offered, or traded.

Additionally, comprehending the volatility linked with copyright markets is essential, as costs can fluctuate considerably within brief periods. Regulative factors to consider additionally play a significant function, as various nations have varying stances on copyright, impacting its use and acceptance. By comprehending these foundational aspects, possible capitalists can make enlightened decisions as they browse the intricate globe of cryptocurrencies.

Key Benefits of copyright Financial Investment

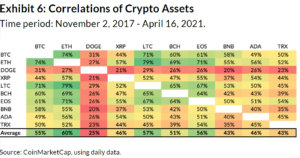

Buying cryptocurrencies provides a number of engaging benefits that can bring in both amateur and experienced financiers alike. One of the key advantages is the possibility for significant returns. Historically, cryptocurrencies have displayed exceptional rate admiration, with very early adopters of assets like Bitcoin and Ethereum realizing significant gains.Another key advantage is the diversification opportunity that cryptocurrencies offer. As a non-correlated asset class, cryptocurrencies can serve as a bush against conventional market volatility, allowing investors to spread their risks across numerous financial investment cars. This diversification can boost total profile efficiency.

Additionally, the decentralized nature of cryptocurrencies uses a level of autonomy and control over one's assets that is often doing not have in standard financing. Financiers can manage their holdings without intermediaries, potentially reducing fees and raising openness.

Furthermore, the growing approval of cryptocurrencies in mainstream financing and commerce better strengthens their worth proposal. Numerous businesses currently accept copyright payments, leading the way for broader fostering.

Finally, the technological innovation underlying cryptocurrencies, such as blockchain, offers chances for investment in arising sectors, consisting of decentralized finance (DeFi) and non-fungible symbols (NFTs), enriching the investment landscape.

Significant Risks to Take Into Consideration

One more vital danger is regulatory uncertainty. Federal governments worldwide are still formulating plans regarding cryptocurrencies, and modifications in regulations can substantially impact market characteristics - order cryptocurrencies. An undesirable regulatory atmosphere can restrict trading or visit the site even bring about the banning of specific cryptocurrencies

Protection risks also present a significant risk. Unlike typical financial systems, cryptocurrencies are vulnerable to hacking and scams. Capitalist losses can take place if exchanges are hacked or if private keys are jeopardized.

Finally, the absence of customer defenses in the copyright space can leave investors susceptible - order cryptocurrencies. With restricted choice in the occasion of fraudulence or theft, individuals may discover it challenging to recuperate lost funds

Due to these threats, thorough research and risk assessment are important before participating in copyright investments.

Methods for Successful Investing

Creating a durable technique is vital for navigating the complexities of copyright financial investment. Financiers ought to begin by performing complete research study to understand the underlying modern technologies and market dynamics of various cryptocurrencies. This consists of remaining informed concerning patterns, regulatory growths, and market belief, which can considerably affect asset performance.

Diversity is another vital method. By spreading investments throughout multiple cryptocurrencies, capitalists can reduce dangers associated with volatility in any kind of single property. A well-balanced profile can supply a buffer versus market fluctuations while enhancing the possibility for returns.

Setting clear financial investment objectives is vital - order cryptocurrencies. Whether aiming for short-term gains or lasting wealth buildup, defining specific purposes helps in making notified choices. Executing stop-loss orders can additionally protect investments from substantial downturns, permitting a regimented leave strategy

Finally, continual monitoring and reassessment of the financial investment approach is vital. The copyright landscape is dynamic, and consistently assessing efficiency versus market conditions makes sure that financiers remain active and responsive. By sticking to these approaches, financiers can boost their chances of success in the ever-evolving world of copyright.

Future Trends in copyright

As financiers fine-tune their methods, recognizing future trends in copyright becomes increasingly important. The landscape of electronic currencies is developing quickly, influenced by technical innovations, governing growths, and shifting market dynamics. One substantial fad is the surge of decentralized money (DeFi), which intends to recreate typical economic systems making use of blockchain modern technology. DeFi procedures are getting traction, providing innovative financial products that can improve exactly how individuals engage with their assets.One more emerging imp source trend is the expanding institutional rate of interest in cryptocurrencies. As companies and economic organizations embrace digital money, mainstream acceptance is most likely to boost, potentially leading to higher price security and liquidity. Furthermore, the assimilation of blockchain modern technology into numerous markets hints at a future where cryptocurrencies work as a backbone for purchases across fields.

Innovations in scalability and energy-efficient agreement devices will certainly resolve concerns surrounding deal rate and ecological influence, making cryptocurrencies extra viable for day-to-day usage. Understanding these trends will be vital for capitalists looking to browse the intricacies of the copyright market effectively.

Conclusion

Report this wiki page